Australia's Life Underinsurance Gap

1 Aug 2024 • General Knowledge

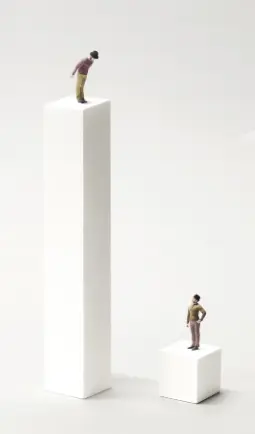

Despite approximately 15 million Australians currently holding life insurance, there remains a considerable gap between the coverage people have and the coverage they need. This gap poses serious risks, especially when it comes to life-altering events such as death, illness, or disability.

What's causing the gap?

Inadequate Coverage

Many Australians have life insurance through their superannuation funds, but these policies often fall short of meeting their actual needs. Default group insurance, which provides coverage for death and Total Permanent Disability (TPD), frequently doesn't align with what people truly require - particularly as they age, start families, or purchase homes. Leaving many Australians without sufficient protection.

Declining Adviser Numbers

The financial advice industry has seen a sharp decline in advisers, with with over 2,000 leaving the profession in 2022 alone. This has made it harder for Australians to access professional advice on life insurance. As adviser numbers shrink, fewer people are adequately covered, increasing the risk of financial hardship.

The Consequences

Underinsurance is more than just a financial issue - it affects families, communities, and the broader economy. When individuals are underinsured, they risk significant financial hardship in the event of death, illness, or disability. This burden often spills over into the community, family and friends.

How Keep Insurance Co is Addressing the Gap

Direct, Online Access

We offer a fully online platform that makes it easy for you to take charge of your life insurance needs. No more waiting for appointments or navigating complex jargon - everything you need is at your fingertips, whenever you need it.

Transparent Pricing with Commission Returns

One of our standout features is our commission return model, where we give back a portion of the commission directly to you. This means you can get more affordable coverage without compromising on quality. It's part of our commitment to transparency and value, ensuring you know exactly what you're paying for.

Tailored for Simplicity

We understand that life insurance can be confusing, but it doesn't have to be. Our platform is designed for modern consumers who want to manage their insurance independently and easily. Whether you're transfering your existing coverage or getting insured for the first time, Keep Insurance Co makes the process simple and straightforward.

The Path Forward

Underinsurance in Australia is a complex issue, but with the right tools and resources, it can be addressed. At Keep Insurance Co, we're not just offering insurance - we're offering peace of mind. By providing a user-friendly platform that simplifies the process and returns value to our customers, we're helping more Australians get the coverage they need.