How Much Does Life Insurance Cost in Australia? (2026)

An overview of average life insurance costs in Australia in 2026, including pricing by age, gender, and cover amount across major insurers.

When you're asking "How much does life insurance cost in Australia?" the answer can be hard to find! Premiums vary widely depending on a number of factors - including your age, health, occupation and more, so the answer is often the unhelpful “it depends.”

That's why we've built this premium guide—to show real numbers, factors that affect your pricing, and tools to help you compare quickly.

Life insurance is just one part of protecting your income and family. If you're also comparing costs for cover that replaces your salary, see our guide to Income Protection costs in Australia .

📊 Monthly Life Insurance Premiums by Age, Gender & Smoking Status

One of the most significant drivers of life insurance cost is age. The older you are, the more expensive your monthly premiums—especially from age 45 and up. Gender and smoking habits also impact how much you'll pay for life cover. Premiums can nearly double from your 30s to 50s, and smokers may pay twice as much as non-smokers.

Quick answer: Life insurance in Australia typically costs between $25-$300+ per month, depending on age, cover amount, smoking status and policy type.

| Age Band | Male Non-Smoker | Male Smoker | Female Non-Smoker | Female Smoker |

|---|---|---|---|---|

| 25-29 | $26 | $46 | $18 | $35 |

| 30-34 | $22 | $43 | $17 | $33 |

| 35-39 | $21 | $48 | $17 | $35 |

| 40-44 | $24 | $64 | $19 | $45 |

| 45-49 | $36 | $102 | $29 | $68 |

| 50-54 | $67 | $176 | $52 | $113 |

| 55-59 | $205 | $322 | $103 | $205 |

Note: Based on $500k cover, clerical occupation, age stepped premiums. As at 1 January 2026.

Want a more personalised estimate? Try this quick calculator.

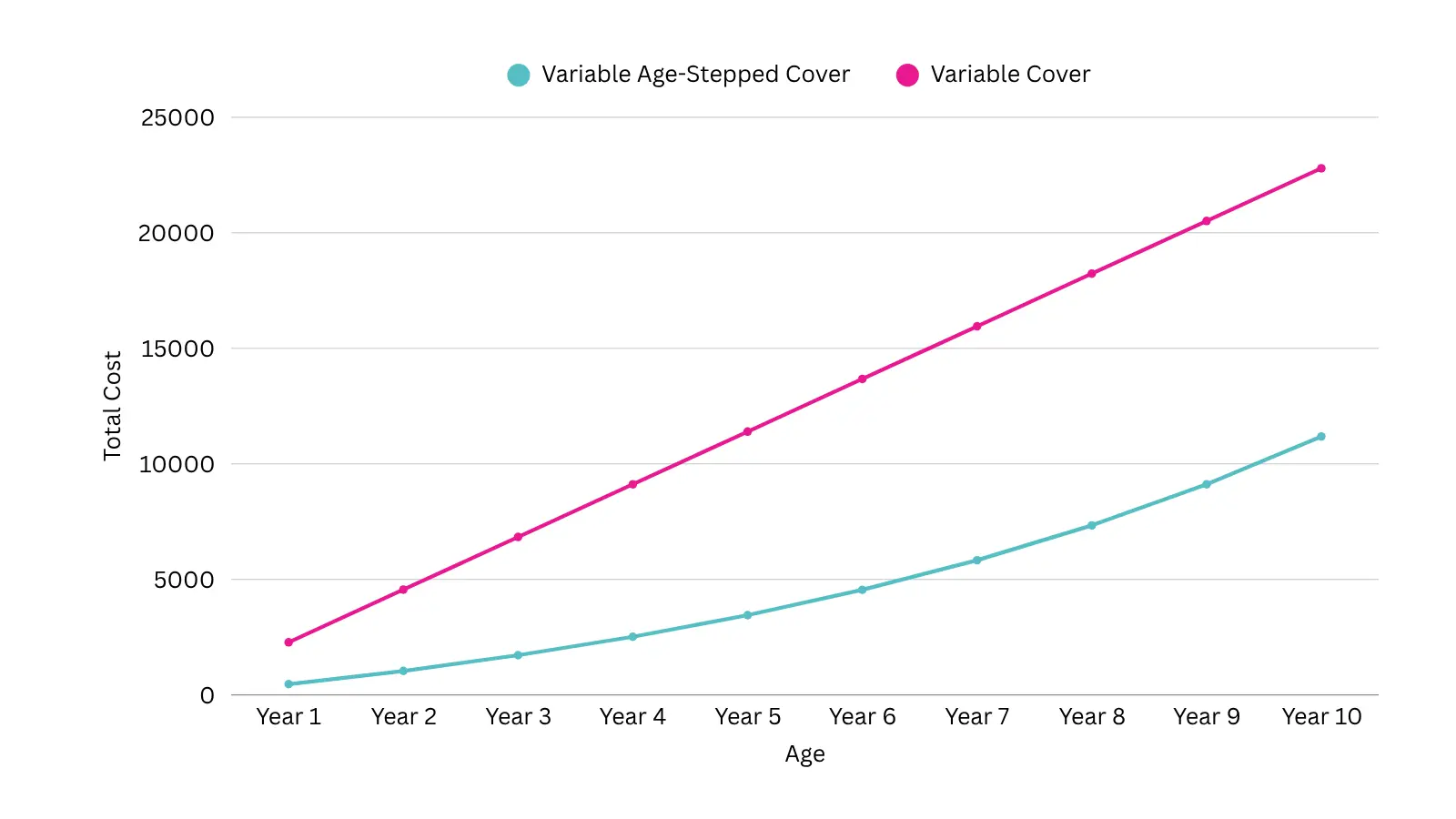

🔁 Variable Age Stepped vs Variable Premiums - Which Costs Less Long Term?

When choosing life insurance, you'll need to decide between Variable Age-Stepped and Variable premiums. Yeah, we know - helpful naming! What that means is:

- ➤Variable Age Stepped: Starts cheaper, but increases each year as you age.

- ➤Variable: Starts higher, but stay largely the same. You should note it can increase by CPI or through insurer premium changes.

🧠 Tip: If you plan to keep your policy more than 10 years, variable premiums can be more cost-effective.

This is the average projection analysis we did over a 10-year period.

🧠 What Changes Life Cover Costs?

| Factor | Impact on Premiums |

|---|---|

| 🕒 Age | Older = higher cost |

| 🚬 Smoking | Adds 30-100% depending on product |

| 🚻 Gender | Males pay more for Life; females for Income Protection |

| 📊 Premium Type | Variable vs Age-Stepped changes long-term costs |

🚭 Why Smoking Impacts Life Insurance Costs

Smoking is a major health risk — and insurers price that risk in. On average, smokers pay:

- 💸100% more for life insurance

- 💸30–50% more for income protection

If you've been smoke-free for 12 months, many insurers will reclassify you as a non-smoker — unlocking significant premium savings.

🏷️ Why Comparing Providers Can Save You 50%

One of the most important cost insights? Life insurance prices vary massively between insurers. For the same person and cover we found an average 50% premium difference between the cheapest and most expensive providers.

That's why it's critical to compare quotes—not just for the lowest price, but for the best value in terms of cover, exclusions, and claims experience..

Frequently Asked Questions

✅ Summary: Key takeaways for 2026

- Smokers pay up to double the premium.

- Life insurance gets expensive from age 45+.

- Stepped vs. level premiums impact long-term pricing.

- Comparing insurers can cut your costs by 50%.